Investing in innovation and partnerships to drive impact

Climate Investment (CI) is an independently managed, specialist decarbonization investor founded by members of the OGCI. Our mission is to drive near-term greenhouse gas emissions reduction through investment and market adoption of our portfolio company innovations across our network of investors and global partnerships.

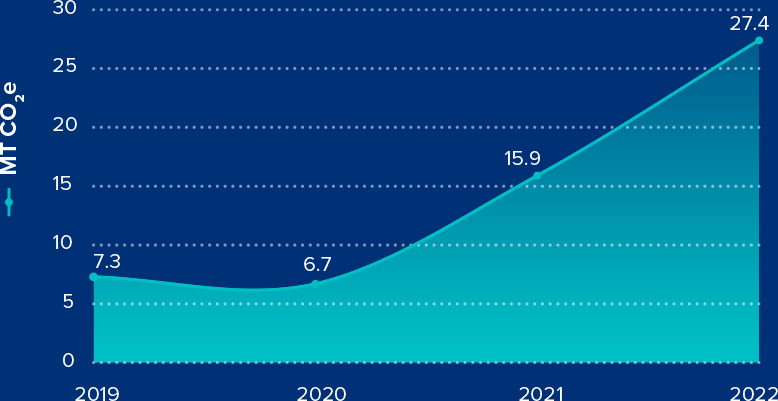

Over the past six years, we have built a portfolio of 36 companies with innovative products and services, operating in the energy, transportation, built environment and industry sectors. The portfolio delivered 27.4 million tonnes (Mt) CO22e of impact in 2022, greater than the avoided emissions from the entirety of the onshore wind capacity added in the US in 2021 (13 GW) operating for one full year, and since 2019, has delivered 57 Mt of CO2e of GHG impact.

Achieving high levels of impact requires a differentiated approach and providing capital investment alone is not enough. The climate problem requires a “systems” approach as there are no silver bullets; innovations will need to be embedded in existing physical and human processes, all of which require knowledge and time.

This is why CI stands out as a truly differentiated investor. Our team has over 200 years of investing experience, coupled with over 380 years of technology development and deployment across the different sectors we invest in. Together, we curate disruptive, transformative technologies, and advance market opportunities for them with our investors. Those partnerships are driving the decarbonization results we are seeing in our portfolio.

Investors recognize our approach is tangibly differentiated, focused on enabling them to decarbonize their businesses and support delivery of their impact goals. Innovators recognize that our model is designed to mobilize their technologies’ adoption and maximize their impact.

The CI team has facilitated over 135 deployments and commercial contracts between our portfolio companies and investors. These partnerships validate those portfolio companies’ technologies, establish their market credibility and cultivate their adoption, accelerating impact results. In turn, adoption costs fall and cost-effective global markets open up for decarbonization products and services.

Why investors value the CI investment platform

What we offer is hard for other funds to replicate.

Team expertise

Investors and portfolio companies benefit from our team’s breadth of technology, industrial and investment skills and expertise. With years of experience and embedded relationships across both the impact-focused investment community and corporate operations, our team is valued for its vision and technical acumen, as well as for the commercial opportunities it initiates.

Value sharing

The partnerships we help create accelerate impact and help our portfolio companies develop into commercially sustainable and successful enterprises whose solutions can be adopted widely and drive business change at scale. Our investors gain both commercial and investment exposure to these companies, often choosing to co-invest on our deals and participate in portfolio companies’ future funding rounds. As CI investors, they are offered regular opportunities to contribute their expertise and benefit from bilateral exchanges with other investors, gaining insights that they can integrate within their own businesses.

Operational rigour

Impact quantification is fundamental to ensuring our portfolio is delivering the GHG impact we expect. We have prioritized the operational implementation of our methodology, deploying it consistently across our portfolio and ensuring it is independently assessed. Our transparent and robust approach provides confidence. It is applied from deal evaluation to exit and our portfolio companies trust and incorporate it within their businesses. This helps them to attract both investment and customers.

“Achieving high levels of GHG reduction quickly requires more than just capital. It needs a dedicated team closing market gaps and driving adoption.”

Dr Pratima Rangarajan,

CEO, Climate Investment

Portfolio

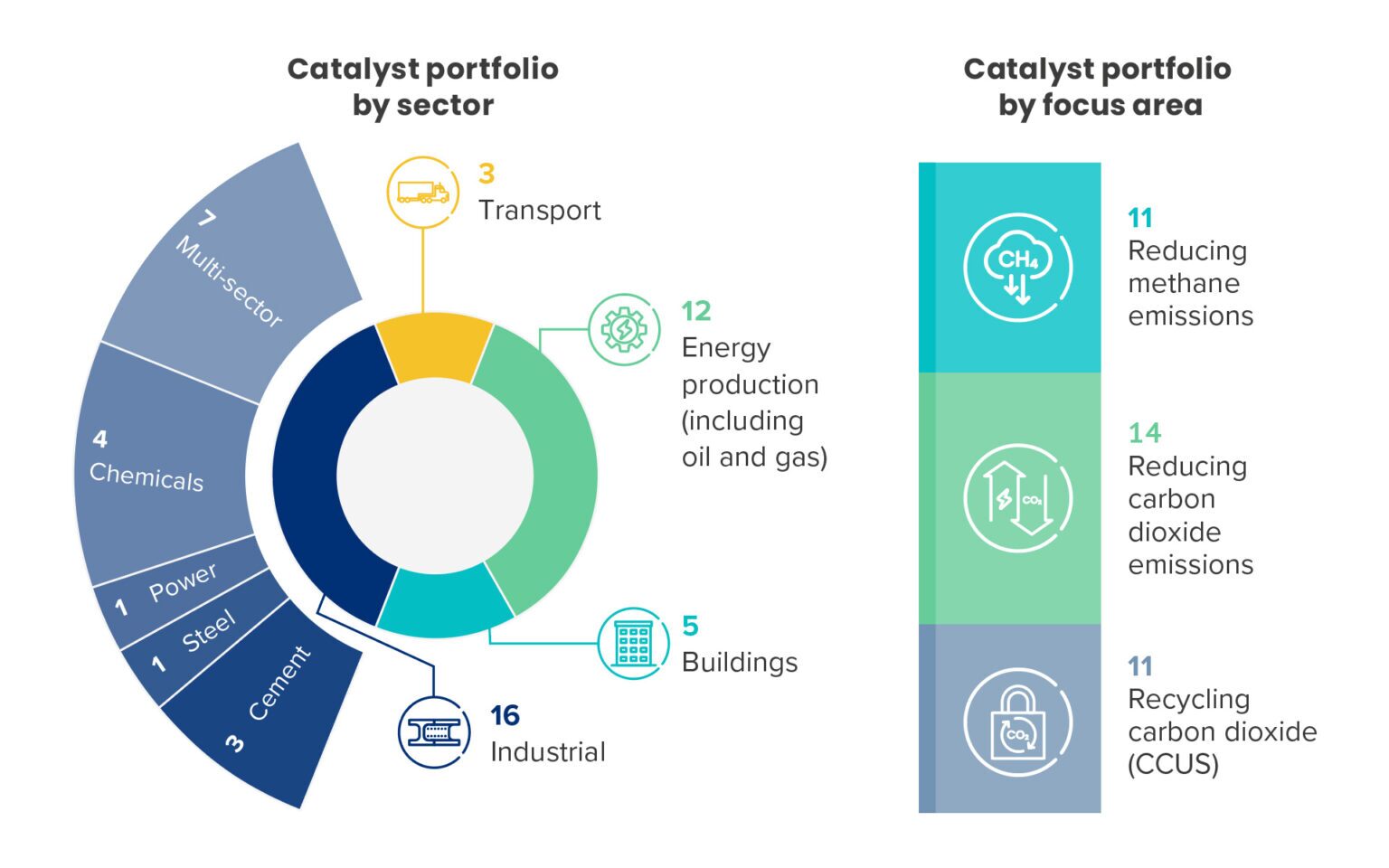

Our strategy addresses GHG emissions reduction, energy efficiency and carbon capture, recycling and/or storage (CCUS). We champion the development of circular markets, waste reduction, resource conservation and opportunities to create a sustainable decarbonization of the global economy.

Our portfolio construction considers what solutions multi-sector investors will need for their businesses and we take a systems-level approach to it, as we understand that there will be no single solution to energy transition.

Methane Emissions Reduction Portfolio

Since our first investment, significant momentum has built around the need to stem methane emissions. Various initiatives, including the OGCI’s Aiming for Zero campaign, the Oil & Gas Methane Partnership 2.0 (OGMP 2.0), and the US Inflation Reduction Act provide the favourable backdrop and the incentive for operators to act. We continue to seek out innovations that can be transformative and to add these to our Methane Portfolio.

The 11 innovations in our methane emissions reduction portfolio span detection, measurement and mitigation. Between January 2022 and August 2023, we added three new investments: F2V4, ICA-Finance and SensorUp.

Carbon Dioxide Emissions Reduction Through Energy Efficiency

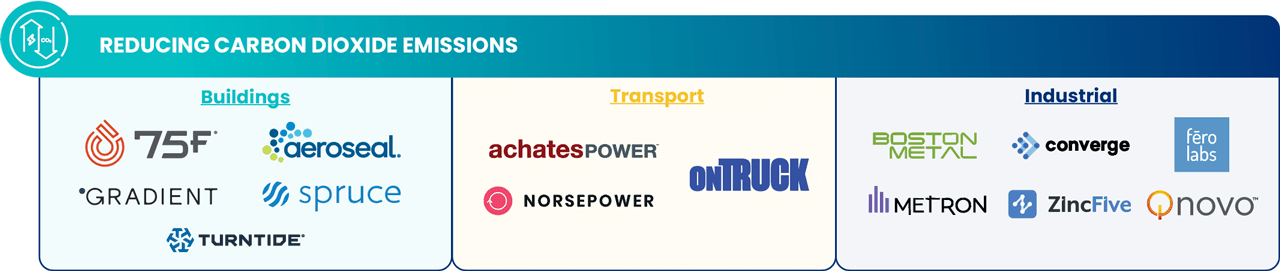

Energy security and climate collided in 2022, resulting in mixed responses where many stakeholders reined-in climate resolutions while others stepped forward with initiatives that could make a significant dent in demand and CO2 emissions. We continue to build our promising energy efficiency portfolio of cost-efficient solutions that are also lower in resource utilization and emissions, and which address several high-emitting sectors. Our fourteen energy efficiency technologies optimize operations within factories and plants, commercial and residential buildings, transportation in ships, trucks and in battery technology.

In the period January 2022 to August 2023, we added four new investments: Aeroseal, Fero Labs, Gradient Comfort and Carbon Upcycling Technologies.

Carbon Capture, Recycling and Storage (CCUS)

The potential of the CCUS market continues to grow, and this potential was enhanced by the US Inflation Reduction Act, the expansion of the EU Emissions Trading Scheme, and strong global carbon prices. However, the CCUS industry is still in its early stages, since the process of securing the requisite permits and building necessary infrastructure remains slow.

Nonetheless, we continue to seek out and execute differentiated opportunities to make new or follow-on investments. By providing development capital to companies initiating and/or operating CCUS platforms, we catalyze the future business models that can deliver carbon capture, recycling and storage at scale. We have 11 investments in our CCUS portfolio. Between January 2022 and August 2023, we added two new investments to our CCUS Portfolio, Keystate and Trace Carbon Solutions. Additionally, during 2022, policy incentives and a recognition of the importance of CCUS in achieving the energy transition resulted in CI portfolio company, Svante, raising significant capital from its series E round, alongside a successful capital raise from Econic Technologies.

The future

As we look to the next five years, we have initiated a new growth equity investment strategy and intend to raise additional capital for our venture capital Catalyst program. Expanding our coverage through the early to growth stage spectrum provides enhanced opportunities for our investors to incorporate scalable, proven solutions within their businesses.

We are delighted to welcome our new investors. Together, we are driving market adoption, reducing innovation costs, and creating a global market of cost-effective decarbonization solutions. We encourage others to join us on our mission as we grow and evolve our unique model.

- Calculated by inputting the portfolio impact figures into the EPA’s GHG Equivalency Calculator

- We define GHG impact as GHG avoided, reduced, stored or recycled

- CI internal data as of September 2023. Please note that years of experience across different sectors and functions may overlap.

Our investment in F2V applies the principles of carbon utilization to methane emissions from flaring, reusing the methane instead of combusting it.