- OGCI, S&P Global report sees opportunity for CCUS to decarbonize Brazil’s iron, steel and ethanol industries, while creating economic value and jobs

- Eight CCUS hubs could contribute up to US$3.2 billion to Brazil GDP and 210,000 new jobs

- CCUS seen as an essential technology to achieve the Paris Agreement net zero targets

Carbon capture, utilization and storage (CCUS) could help Brazil’s industrial sector decarbonize – supporting the country’s net zero ambitions while adding billions of dollars to the economy and thousands of new jobs, the Oil and Gas Climate Initiative said in a new study published today.

CCUS is widely viewed as an essential technology that can decarbonize hard-to-abate industries such as steel, chemicals and cement and is one of the most cost-effective ways to achieve the Paris Agreement net zero ambitions. CCUS can also enable the production of lower-carbon fuels and products such as hydrogen, and help decarbonize parts of the power sector.

“This report shows there’s significant potential to develop CCUS hubs in Brazil. The opportunity extends beyond reducing emissions to include the creation of economic value and jobs, while also helping to grow carbon markets as we transition to a net-zero emissions future,” said Ana Paula Santana Musse, OGCI CCUS Workstream Petrobras representative.

OGCI’s report, CCUS Hubs in Brazil: Making the Case, Breaking the Barriers evaluates the economic case for CCUS in Brazil for its iron, steel and ethanol industries.

It notes the presence of significant carbon dioxide storage potential and highlights the business models and policy levers currently in use elsewhere that could be deployed in Brazil to encourage the development of CCUS hubs.

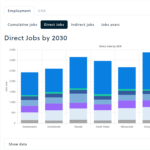

According to the report, which is based on a study by S&P Global, eight CCUS hubs could capture up to 88 million tonnes of CO2/year, while contributing up to US$3.2 billion per year to Brazil’s GDP and creating up to 210,000 new jobs.

The study identified eight sites across Brazil that could store carbon dioxide. This includes two areas off the country’s southeast coast that could potentially store more than 21 gigatonnes of CO2.

The study said that policy certainty, including clear CCUS regulations at the federal level, combined with a reduction in import taxes, could reduce CCUS costs in Brazil by an average of 18% across the seven sectors that were analyzed.

Brazil can look to overseas models for policy frameworks that facilitate CCUS development, including via tax and fiscal policy, research and development support and more, the report added.

Background:

- OGCI has worked with other organizations to help the industry broaden its approach to include the build out of large interconnected regional CCUS hubs that can store emissions from multiple different high-emitting industries using shared transport and storage infrastructure.

- OGCI’s member companies are now actively involved in developing over 40 large-scale CCUS hubs around the world. The hubs OGCI members are involved in have the potential to capture over 300 million tonnes of CO2 a year by 2030.

- The International Energy Agency’s Clean Energy Tracker sees a need for 1.2 gigatonnes a year of CCUS capacity to keep the world on track to net zero.

OGCI

- OGCI is a CEO-led initiative comprised of 12 of the world’s leading oil and gas companies.

- It aims to lead the oil and gas industry’s response to climate change and accelerate action toward a net zero emissions future consistent with the Paris Agreement.

- Over the past decade OGCI members have demonstrated the essential role that oil and gas companies can play in delivering a net zero future.

- Since 2017, our members have collectively halved methane emissions and cut flaring by 45%, invested $65bn in low-carbon technologies and shared best practices across our industry and other sectors to accelerate decarbonization.

- OGCI’s members are Aramco, bp, Chevron, CNPC, Eni, Equinor, ExxonMobil, Oxy, Petrobras, Repsol, Shell, TotalEnergies.