OGCI has been collecting third-party reviewed aggregated emissions data from our member companies and publishing the data in our annual Progress Report since 2017.

Our Performance Data includes oil and gas production, greenhouse gas emissions (operated and equity), operated upstream carbon intensity, methane emissions and intensity, flaring, and investment and R&D in low-carbon technologies. Published data and percentages are rounded. Dollars in this report are USD.

- See Reporting Framework for definitions and methodology.

- See table notes for reporting scope and boundary.

- All reported data is the aggregate for 12 companies, (unless otherwise stated in the tables), and independently verified by EY.1

Key takeaways

Seven years of data show that OGCI member companies are making progress reducing greenhouse emissions from oil and gas operations under their control and increasing investments in the low-carbon technologies and solutions that will be needed for a net zero emissions future.

Since 2017, OGCI’s collective Scope 1 greenhouse gas emissions from operated assets have decreased 19% and upstream carbon intensity has decreased 21%.

Since 2017, OGCI’s upstream methane intensity and total methane emissions – upstream and across all sectors – are more than 50% lower. Over the same period GHG emissions from upstream flaring have decreased by 47%.

OGCI Performance Data Hub

OGCI’s new data hub provides greater accessibility to our emissions data and low-carbon investment data, supporting our commitment to reporting and transparency.

Production

Total operated oil and gas production in 2023

Of global oil and gas production in 2023

Share of natural gas in operated portfolio in 2023

In 2023, aggregate operated oil and gas production from the 12 OGCI member companies was 1% lower year-on-year at 43.3 Mboe/day. OGCI member companies operated 26% of global oil and gas production in 2023.5

Factors including divestments, reclassification of an LNG asset from operated to non-operated and reduced demand and sales, offset an increase in oil and gas production across some companies.

Oil production decreased 1% compared with the previous year, while gas production was 3% lower.

Production trends across the companies was mixed. In 2023, oil production was slightly lower on the year as divestments and lower demand and sales at some companies offset an increase in production at other companies from new wells, fields and stronger demand.

Gas production was lower mostly due to planned shutdowns for maintenance, repair and upgrades, divestments and the reclassification of an asset to non-operated.

Loading..........

The Data is Not Available

Notes: 1. 2021 and 2022 data restated

Greenhouse gas emissions (operated)

Upstream carbon intensity in 2023

Upstream carbon intensity

2023 vs 2017

Total operated GHG emissions (Scope 1) in 2023

OGCI’s member companies are making good progress towards the group’s 2025 collective upstream carbon intensity target of 17 kg/boe.

In 2023, OGCI’s collective upstream carbon intensity fell to 17.9 kg/boe, a 1% decrease compared to the previous year.

This brings the total reduction in carbon intensity since 2017 to 21%.

In 2023, OGCI members’ aggregate Scope 1 greenhouse gas (GHG) emissions at operated assets from all sectors (including upstream and downstream) was 575 Mt CO2e.

This is a 3% decrease compared to the previous year and a 19% decrease since 2017.

OGCI members aggregate Scope 1 operated GHG emissions of 575 Mt CO2e represents 1% of global greenhouse gas emissions, using latest 2022 data from UNEP’S Emissions Gap Report published in 2023.6

Scope 1 upstream GHG emissions fell by 2% over the year (and a total of 23% since 2017), due to methane emissions reductions, energy efficiency investments, projects to reduce carbon emissions in exploration and production, and divestments.

Scope 2 upstream operated GHG emissions were up 3% over the year due to factors including the addition of a refinery to 2023 data, an increase in production and acquisitions and an increase in specific emissions factors for electricity.

Overall since 2017, Scope 2 upstream operated GHG emissions decreased 9%.

Downstream, which accounts for around half of OGCI member companies’ aggregate Scope 1 greenhouse gas emissions, has shown slower progress than upstream, reflecting the complexity and longer timelines of emissions reduction efforts in refineries.

Loading..........

The Data is Not Available

Notes:

I. This is the key performance indicator for OGCI’s upstream carbon intensity target. It includes upstream carbon dioxide and methane emissions, both Scope 1 and 2, on an operated basis. It excludes emissions from gas liquefaction and gas-to-liquids.

II. This figure includes direct (Scope 1) emissions of carbon dioxide, methane and nitrous oxide (for those companies that report it) from all operated activities (upstream as well as downstream, which includes refineries and petrochemicals). The methane emissions were converted to CO2 equivalent using a 100-year time horizon global warming potential (GWP) of 25 for fossil-based methane as per IPCC AR4. Using the IPCC AR6 GWP of 29.8, the operated greenhouse gas emissions were 595 MtCO2e in 2022 and 580 MtCO2e in 2023.

III. Upstream activities comprise all operations from exploration to production and gas processing (up to the first point of sale), including LNG liquefaction plants if located before the first point of sale.

IV. Scope 2 emissions were not calculated in a homogenous way across companies, with some using a location-based and others a market-based methodology.

V. 2021 and 2022 data restated.

Greenhouse gas emissions (equity)

Scope 1 equity GHG emissions in 2023

Scope 2 equity GHG emissions in 2023

Total equity methane emissions in 2023

This is the second year we are publishing equity emissions, in line with OGCI’s ambition of greater transparency.

Equity reporting includes emissions from assets owned, even where they are operated by partners.

In 2023, total greenhouse gas emissions on an equity basis for Scope 1 and Scope 2 were 575 Mt CO2e and 84 Mt CO2e respectively.

In 2023, total Scope 1 equity GHG emissions fell by 3% compared to the previous year. Scope 2 equity emissions increased by 1% due to reductions in energy attribute certificates and the rise in emissions factors for certain national electricity mixes.

Total methane emissions on an equity basis were 0.88 Mt of methane in 2023, a 6% decrease compared with the previous year.

Loading..........

The Data is Not Available

Notes: I. 2021 and 2022 data restated

Methane emissions (operated)

Upstream methane intensity in 2023

Upstream methane intensity

2023 vs 2017

Total operated upstream methane emissions

2023 vs 2017

OGCI members reported an aggregate upstream operated methane intensity of 0.14% in 2023, a 5% decrease year-on-year and 54% lower compared with 2017.

OGCI members had already achieved their collective methane intensity target of well below 0.20% in 2021 – four years early.

In 2023, total operated upstream methane emissions were 0.89 Mt CH4. This represents a 7% decrease compared with 2022 and a 55% decrease versus 2017.

The year-on-year reduction is mainly a result of continued equipment and system upgrades, improved flaring controls, continued leak detection and repair, and improved calculation methodologies. Divestment of assets also played a role for some companies.

The upstream sector accounted for around 90% of OGCI total methane emissions in 2023. Venting and fugitive leaks accounted for over almost 70% of total upstream methane emissions.

OGCI member companies are striving to reach near zero methane emissions from their operated assets by 2030. They are sharing what they are learning about detection, measurement and abatement across the industry.

Loading..........

The Data is Not Available

Notes:

I. This is the key performance indicator for OGCI’s 2025 upstream methane target of well below 0.20%. It includes total upstream methane emissions from all operated gas and oil assets. Emissions intensity is calculated as a share of marketed gas.

II. This figure includes relevant operated activities (upstream, refineries, petrochemicals, power generation, etc, where these are operated by the company).

III. 2021 and 2022 data restated.

Flaring (operated)

Upstream flaring intensity

2023 vs 2017

Total routine flared gas upstream

2023 vs 2018

GHG emissions from upstream flaring

2023 vs 2017

OGCI member companies continued to reduce flaring volumes and related greenhouse gas emissions from flaring in 2023, in line with their ambition to end upstream routine flaring and achieve near zero methane emissions from operated oil and gas assets by 2030.

In 2023, upstream flaring intensity increased by 1% year-on-year as volumes of natural gas flared upstream were little changed on the previous year partly due to non-routine flaring events for safety reasons. Overall, upstream flaring intensity in 2023 is 45% lower than the 2017 baseline.

In 2023, GHG emissions from upstream flaring were 4% lower than in 2022 as non-routine flaring events for safety reasons partially offset flaring reduction projects, a divestment and the start up of an LNG plant in 2022.

In 2023, total routine gas flared volumes in upstream fell 10% compared with the previous year due to flaring reduction projects.

Total routine gas flared volumes upstream were 53% lower in 2023 than in 2018 – the first year of published data for this metric.

Some of the reduction since 2018 was attributed to improved production practices, such as flaring reductions for targeted assets, flare gas recovery systems, gas compression and capture projects.

Since 2017, greenhouse gas emissions from upstream flaring have decreased by 47%.

Loading..........

The Data is Not Available

Notes:

I. Upstream flaring intensity is calculated on the basis of the volume of gas flared per millions tonnes of oil equivalent produced on an operated basis.

II. 2021 and 2022 data restated

Investment and R&D in low-carbon technologies

Total low-carbon investment

Since 2017

Low-carbon investment at a record in 2023

Low-carbon investment

2023 vs 2022

R&D spend

2023 vs 2022

In 2023, aggregate low-carbon investment, including acquisitions and R&D totalled a record $29.7 billion. This represents a 15% increase compared with the previous year.

Renewable energy accounted for more than half the investment. Meanwhile, companies reported more organic investment in these types of projects compared to the previous year, which was characterized by large acquisitions.

Investment in CCUS continued to grow with some companies concentrating on the technology as part of their strategies to reduce emissions.

R&D spending on low-carbon technologies increased 17% in 2023 versus the previous year to $2 billion and comprised over a third (35.4%) of total R&D spend.

Since 2017, OGCI member companies’ cumulative investment on low-carbon technologies and projects, including investment, R&D and acquisitions, amounted to $95.8 billion.

Loading..........

The Data is Not Available

Notes:

I. 2021 and 2022 data restated

II. Low-carbon energy technologies include but are not limited to wind, solar and other renewable energies, carbon-efficient energy management, CCUS, blue and green hydrogen, biofuels, synfuels, energy storage and sustainable mobility.

III. R&D spending is additional to investment.

Abbreviations

Mboe/day

Million barrels of oil equivalent per day

kgCO2e/boe

Kilograms of carbon dioxide equivalent per barrel of oil equivalent

Million tonnes of carbon dioxide equivalent

Million tonnes of methane

Million cubic metres

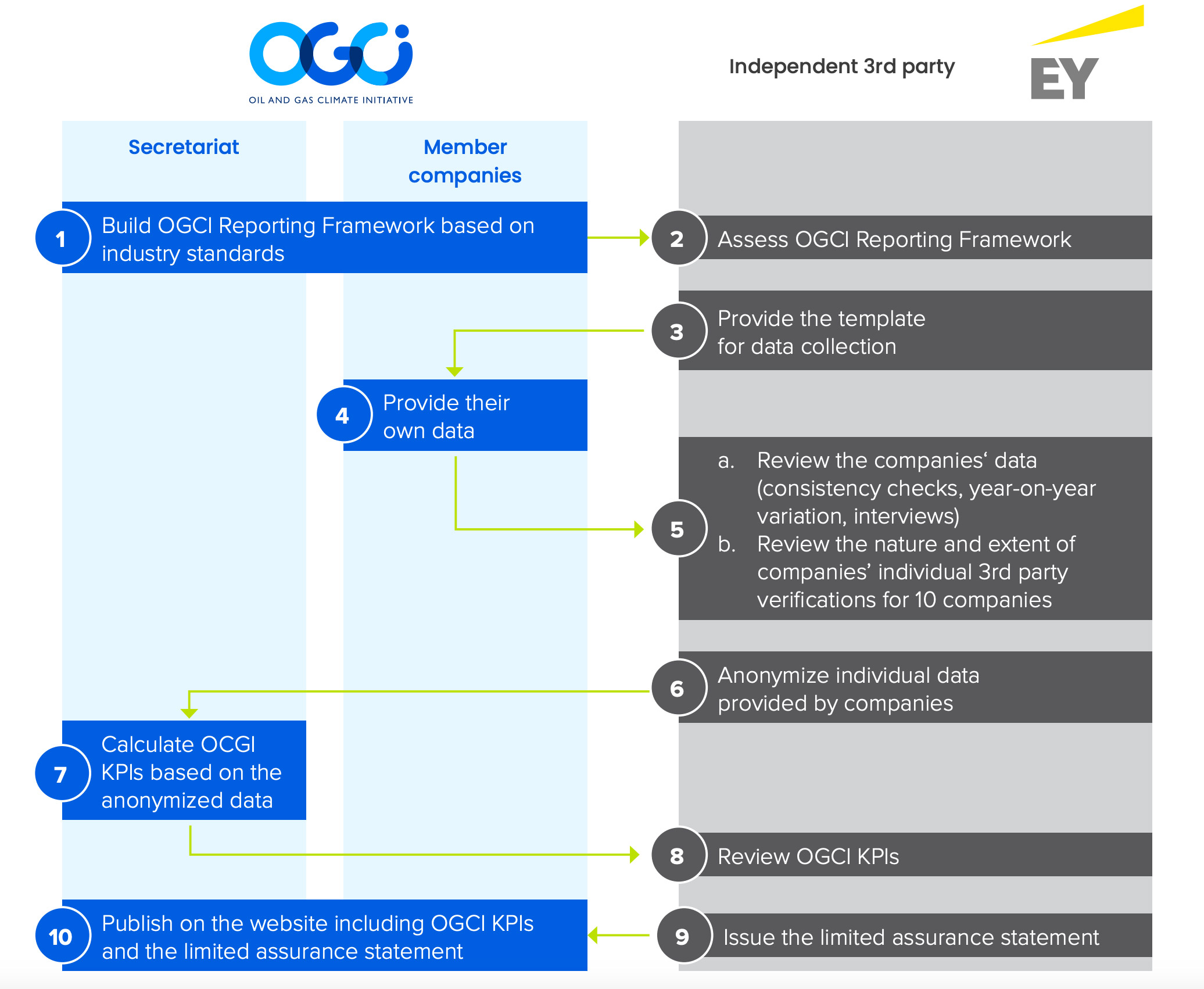

OGCI and EY data consolidation and review process

Since 2016, OGCI has been working with EY & Associés (EY), as an independent third party, to collect and check data consistency, and guarantee the confidentiality of member companies’ data.

We developed together with EY an innovative process, applicable to both listed and state-owned national oil companies, to aggregate information about the level of third-party assurance that member companies apply individually into OGCI data reporting.

Most OGCI member companies already ensure that data reported to OGCI are independently verified. This additional step confirms that OGCI data, as well as information about third-party data assurance, are consolidated, reviewed and challenged in order to increase the reliability of the aggregate data we publish.

Since 2020, we have worked with EY to develop and implement a verification process for a selection of our aggregate data.

EY’s statement this year covers nine of OGCI’s 12 members.

Our process for data consolidation and review

Independent verifier’s report on a selection of indicators for calendar year ended December 31, 2023

We have been engaged by OGCI Climate Investment LLP’s, on behalf of OGCI, to perform a ‘limited assurance engagement,’ as defined by International Standards on Assurance Engagements, here after referred to as the engagement, to report on a selection of OGCI indicators (the “OGCI indicators”) detailed in Appendix 1 contained in OGCI performance data for the year ended December 31, 2023.

Basis for Qualified Conclusion

We had access to the nature and extent of third-party verifications conducted at company level on member-company data for only 10 companies out of the 12 OGCI member companies (representing 59% of the “Operated greenhouse gas emissions – all sectors (Scope 1)” and see Appendix 1 for other OGCI Indicators. For the 2 other companies (representing 41% of the “Operated greenhouse gas emissions – all sectors (Scope 1)” and see Appendix 1 for other OGCI Indicators, either the company independent third party was unable to provide the sufficient level of information on time, or the regulatory timing was not matching OGCI’s timing to enable the production of the relevant documentation on time.

Qualified Conclusion

Based on our work, described in the “Nature and scope of work” section of this report, except for the possible effects of the matters described in the Basis for Qualified Conclusion section, nothing has come to our attention that causes us to believe that the OGCI Indicators are not presented, in all material respects, in all material respects, in accordance with version 3.7 of the OGCI Reporting Framework dated March 2024.

Emphasis of matter

We draw attention to Notes 7.2, 7.3 and Appendix C of the OGCI Reporting Framework and to the OGCI Progress report which describe that:

- For the reporting of GHG emissions, companies can use the same methodology approach used for their public reporting of GHG emissions in other relevant documentation (e.g. Annual Report, Sustainability Report, etc.)

- For methane indicators, several methods of quantification are possible.

- Upstream Scope 2 emissions were not calculated in a homogenous way across companies, with some using a location-based and others a market-based methodology.

- One member company was unable to submit audited performance data in time for the publication of the 2024 Progress report and 2022 data has been used in place of 2023 data.

Our conclusion is not qualified in respect of this matter.

Understanding how OGCI has prepared the OGCI Indicators

The absence of a commonly used, generally accepted reporting framework or a significant body of established practice on which to draw, evaluate and measure sustainability information allows for different, but acceptable, measurement techniques that can affect comparability between entities and over time. Consequently, the OGCI Indicators need to be read and understood together with version 3.7 of the OGCI Reporting Framework dated March 2024, which OGCI has used to prepare the OGCI Indicators.

Responsibility of OGCI

As part of this voluntary approach, it is the responsibility of OGCI to:

- disclose version 3.7 of the OGCI Reporting Framework dated March 2024, available on OGCI’s website;

- consolidate the anonymized member companies’ data and ensure their consistency;

- publish the consolidated OGCI Indicators on OGCI’s website.

Responsibility of OGCI’s member companies

As part of this voluntary approach, it is the responsibility of OGCI’s member companies to report to OGCI their data according to version 3.7 of the OGCI Reporting Framework dated March 2024, to arrange external verification in accordance with OGCI’s and EY’s criteria, and to provide EY with a summary of the nature and details of the verification performed on their data at member-company level, together with associated findings.

Independence and quality management

We have maintained our independence and confirm that we have met the requirements of the Code of Ethics for Professional Accountants issued by the International Ethics Standards Board for Accountants, and have the required competencies and experience to conduct this assurance engagement.

EY also applies International Standard on Quality Management 1, Quality Management for Firms that Perform Audits or Reviews of Financial Statements, or Other Assurance or Related Services Engagements, which requires that we design, implement and operate a system of quality management including policies or procedures regarding compliance with ethical requirements, professional standards and applicable legal and regulatory requirements.

Responsibility of the independent verifier

Our responsibility is to express a conclusion on the presentation of the OGCI indicators based on the evidence we have obtained.

We conducted our engagement in accordance with International Standard on Assurance Engagements 3000 Revised, Assurance Engagements Other Than Audits or Reviews of Historical Financial Information (‘ISAE 3000 (Revised)’) and with professional standards applicable in France. Those standards require that we plan and perform our engagement to express a conclusion on whether we are aware of any material modifications that need to be made to the OGCI indicators in order for it to be in accordance with version 3.7 of the OGCI Reporting Framework dated March 2024, and to issue a report. The nature, timing and extent of the procedures selected depend on our judgment, including an assessment of the risk of material misstatement, whether due to fraud or error.

We believe that the evidence obtained is sufficient and appropriate to provide a basis for our limited assurance conclusions.

It is not our responsibility to give an opinion on the entire annual report or on the compliance of the OGCI Indicators with applicable legal provisions.

Nature and scope of the work

Procedures performed in a limited assurance engagement vary in nature and timing and are less in extent than for a reasonable assurance engagement. Consequently, the level of assurance obtained in a limited assurance engagement is substantially lower than the assurance that would have been obtained had a reasonable assurance engagement been performed. Our procedures were designed to obtain a limited level of assurance on which to base our conclusion and do not provide all the evidence that would be required to provide a reasonable level of assurance.

We conducted the work described below:

- We assessed the suitability of version 3.7 of the OGCI Reporting Framework dated March 2024 in terms of its relevance, comprehensiveness, reliability, neutrality and understandability by taking into consideration the best practices of the oil and gas industry.

- We conducted the following work related to the consistency and the arithmetical accuracy of member companies’ data reported by 12 OGCI member companies with the OGCI Reporting Framework dated March 2024:

- assessment of the appropriate application of version 3.7 of the OGCI Reporting Framework dated March 2024 to the member-company data;

- analysis and investigation of member-company data value change in 2023 compared to 2022 (except for one company);

- calculation of consistency ratios and investigation to identify potential outliers among member-company data.

- We conducted a reconciliation between member company data and publicly-available information.

- We assessed the nature and extent of third-party verification conducted at company level on member-company data against the following topics (hereafter the “Criteria”) through the collection of supporting evidence and interviews with the external third parties of member companies, based on the following:

- level of assurance;

- work program;

- assurance standard;

- audit findings;

- Scope 1 operated emissions coverage reached

with site-level verifications; - physical site visits;

- remote site visits;

- total man days allocated to the verification;

- third-party team members’ competencies.

- We conducted interviews with 12 OGCI’s member companies.

- We reviewed the consolidation performed by OGCI on the anonymized member-company data.

We consider that the work we have performed by exercising our professional judgment allows us to express a limited assurance conclusion; an assurance of a higher level would have required more extensive verification work.

Paris-La Défense, November 13, 2024

EY & Associés Partner, Sustainable Development

Christophe Schmeitzky

Percentage of OGCI Indicators considered as reviewed by an external third party and for which the third-party verification work has been shared with EY

Loading..........

The Data is Not Available

Notes:

I. An indicator is considered as “reviewed” if it was published in a publicly available document and if it was covered by an opinion or conclusion statement provided by an external third party or was reported to a governmental authority and available to the public. None of the opinion/conclusion statements consulted contained any qualification. Only limited and reasonable assurance levels of opinion have been considered.

II. The sum of “Operated greenhouse gas emissions – upstream (Scope 1)” and “Operated greenhouse gas emissions – upstream (Scope 2)” indicators correspond to the numerator of the carbon intensity indicator.

III. Operated methane emissions” indicator is considered reviewed if “Operated methane emissions – upstream” are reviewed, as methane emissions mainly occur in upstream activities. “Operated methane emissions” and “Operated methane emissions – upstream” are not automatically considered as reviewed if only the “Greenhouse gas emissions – all sectors” are reviewed (as methane emissions generally represent a minor fraction of total greenhouse gas emissions).

IV. All indicators are operated. “Operated greenhouse gas emissions – upstream (Scope 1)”, “Operated greenhouse gas emissions – upstream (Scope 2)”, “Natural gas flared – upstream” and “Flaring greenhouse gas emissions – upstream” indicators are considered reviewed if the “Greenhouse gas emissions – all sectors” are reviewed, as they are part of the overall greenhouse gas emissions review.

- One member company has been unable to submit audited performance data in time for the publication of the 2024 Progress Report and 2022 data for that company has been used in place of the 2023 data. Data for 2023 will be updated as needed in the next annual Progress Report, which is expected to be published in the fourth quarter of 2025.

- Provisional estimate of global oil and gas production of approximately 165 Mboe/day in 2023, based on IEA indicators for oil production of 97.8 Mboe/ day and global natural gas production of 67.3 Mboe/day. OGCI member companies’ share of total oil and gas production is 26.2% on an operated basis. Source: IEA Oil Market Report (January 2024), IEA Gas Market Report Q1 2024.

- Total Scope 1 and 2 oil and natural gas-related emissions on an operated basis. IEA: Emissions from Oil and Gas Operations in Net Zero Transitions, OGCI Performance Data.

- Low-carbon energy technologies include but are not limited to wind, solar and other renewable energies, carbon-efficient energy management, CCUS, blue and green hydrogen, biofuels, synfuels, energy storage and sustainable mobility

- Provisional estimate of global oil and gas production of approximately 165 Mboe/day in 2023, based on IEA indicators for oil production of 97.8 Mboe/day and global natural gas production of 67.3 Mboe/day. OGCI member companies’ share of total oil and gas production is 26.2% on an operated basis and 24.8% on an equity basis. Source: IEA Oil Market Report (January 2024), IEA Gas Market Report Q1 2024.

- Total GHG emissions excluding LULUCF was 57.4 Gt CO2e in 2022, UNEP’s latest Emissions Gap Report published in 2023, p. XVI