Climate Investment – a unique investor focused on oil & gas and energy-intensive industries

Climate Investment (CI) is an independently managed, specialist decarbonization investor founded by members of the OGCI.

At CI, we are striving to deliver more than 100 Mt CO2e of greenhouse gas impact per year by 2030 through our portfolio of investments and market adoption of their innovations across our network of investors and global partners.

We invest in companies directly addressing the decarbonization challenges faced by energy-intensive industries, providing operators around the world with targeted, cost-efficient solutions for their businesses. We work with our portfolio companies to find routes to market and to date, CI has facilitated over 185 market deployments – 42 of which were completed last year.

Industrial companies and institutions also invest directly or as co-investors with CI to share more widely in the impact and commercial success of our portfolio technologies. Both OGCI members and non-OGCI companies invest with CI and our model of exchanging insights with our investors enables us to learn from one another’s experiences, as well as identify the technologies that we believe can deliver material carbon emissions impact.

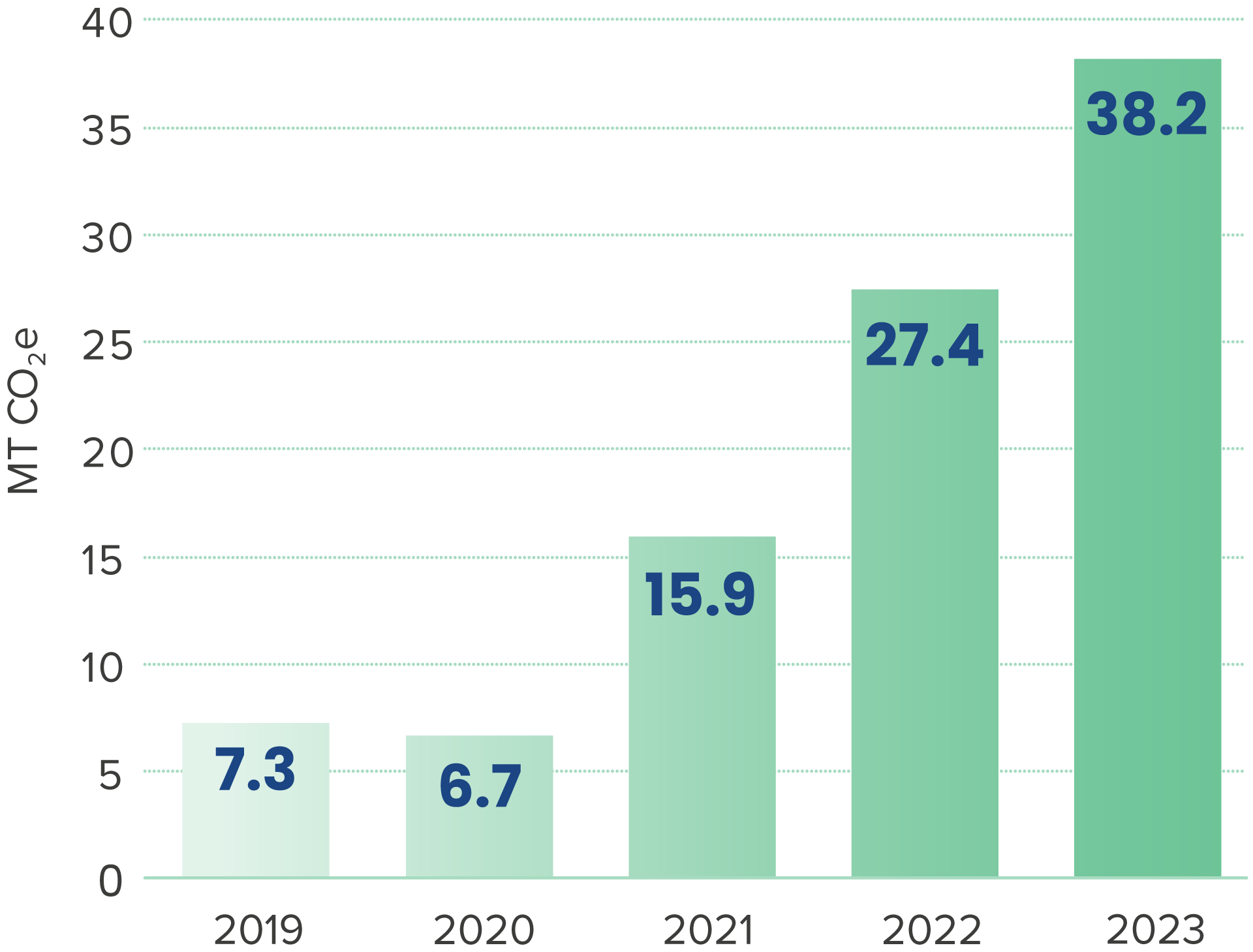

Annual Portfolio Impact (2019-2023)

CI Portfolio’s Annual Impact

Over 2x the annual emissions avoided by all new onshore wind farms in the US in 2022

We focus on allocating capital to where the emissions are most acute; closing the gap between innovators and adopters to support the deployment of new technology; and annually quantifying impact to track progress against our targets.

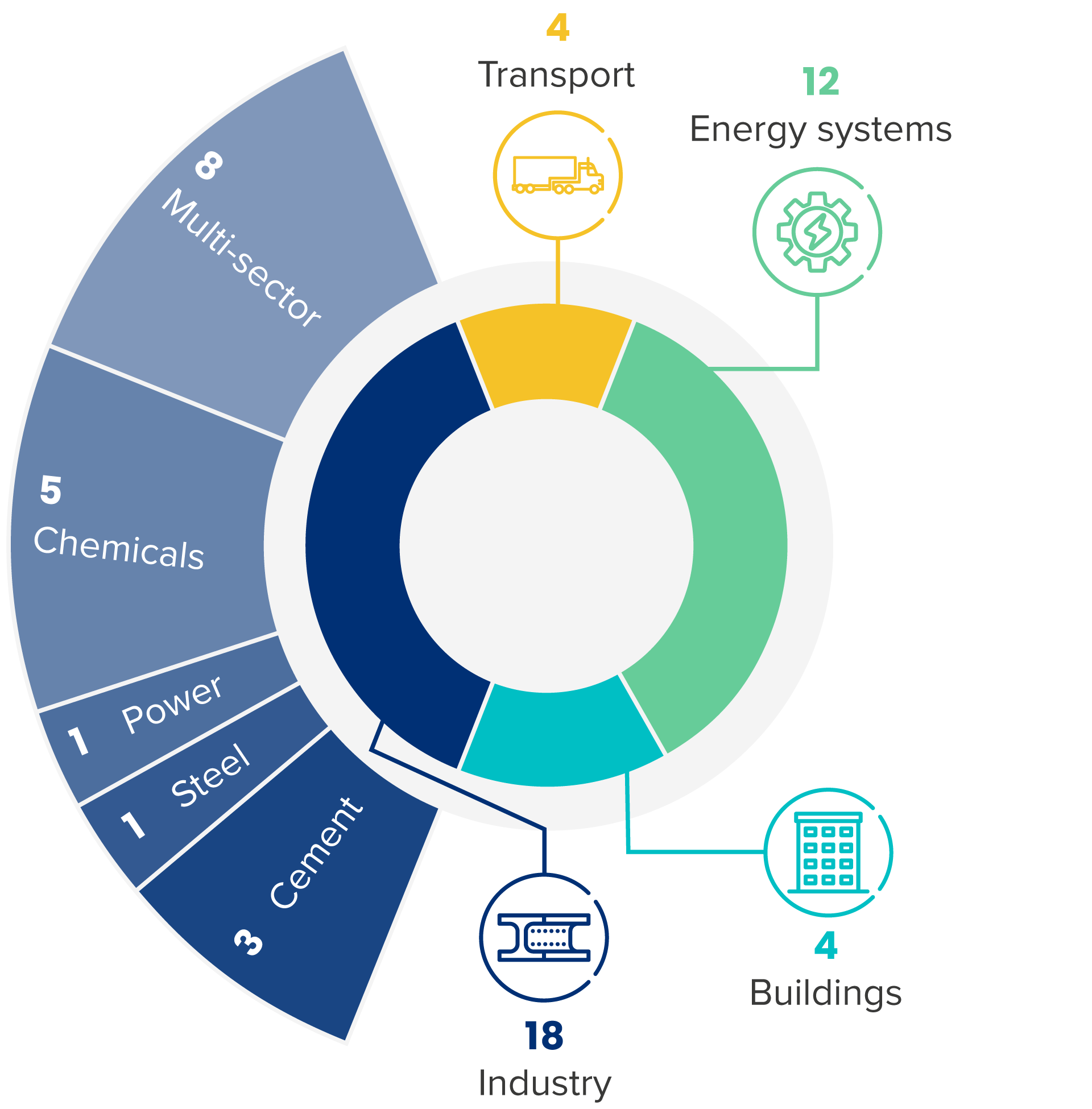

Since our formation eight years ago, we have built a portfolio of 40 companies with innovative products and services, operating in the energy systems, transport, buildings and industry sectors. Over half of the portfolio is invested in technologies that are directly relevant to oil & gas operators.

In 2023 CI’s Catalyst Fund 1 (CF1) portfolio delivered 38.2 Mt CO2e of impact, our strongest year yet. For perspective, this impact is the equivalent to over twice the annual emissions avoided by all new onshore wind farms in the US in 2022. Since 2019, our portfolio has delivered over 95 million tonnes of CO2e of GHG impact, more than the annual emissions of New Zealand.

CI’s portfolio exposure to technologies addressing emissions from energy systems, as well as its 2023 impact delivery are market leading, both in absolute terms, but especially when considering impact per dollar of assets under management.

New investments

In 2023, we made seven new investments in CF1 and supported our existing portfolio through eleven follow-on investments. New investments made during 2023, together with those made since the year-end are summarized below.

CF1 is now approaching the completion of its investment period, and has initiated its first portfolio exits, with two now complete – Elk Hills Carbon LLC and NextDecade.

Please see our Impact Report 2023 and visit our website for details.

new

investments

follow-on

investments

assets under

management

Energy Systems

ICA-Finance develops projects that reduce methane and flare emissions from oil and gas infrastructure.

SensorUp offers a comprehensive methane management platform for oil and gas operators.

Trace develops, builds, and manages carbon capture, transportation, sequestration facilities.

Industry

Cyclic Materials is creating a circular supply chain for rare earth elements (REEs) and other critical materials.

Fero Labs’ industrial AI enables producers of steel, cement, and chemicals to make more efficient production decisions.

Buildings

Aeroseal’s air-sealing technologies for HVAC duct work and building envelopes increase commercial and residential energy efficiency, and can be adapted for adjacent applications such as gas pipes.

Gradient Comfort develops advanced, streamlined air-source heat pumps for window installation in urban apartments.

LuxWall makes glass-based transparent thermal insulation solutions to reduce energy consumption and carbon emissions from buildings.

Transport

Zum provides fully electrified, carbon neutral transportation equipped with vehicle-to-grid technology.

Providing solutions for systems-level industrial decarbonization

CI takes a systemic approach to search for impact, looking across full value chains. This is because the levers for maximum impact may lie in unexpected places, for example, in the design of the product or its means of transportation to market. This requires knowledge and time, and it is why CI stands out as a truly differentiated investor. Our team has over 500 years of aggregate investing, technology development and market deployment experience across the different sectors we invest in.

We believe that what we offer continues to be hard to replicate, making CI an attractive co-investor partner for other climate-focused funds as well as new investees.

As our portfolio companies mature, their need for new forms of capital is increasing. In response, Climate Investment established a growth equity strategy during 2023, which focuses on more established, growth-stage opportunities and which complements our venture capital strategy. We perceive attractive investment, impact and deployment opportunities for global operators and industrial corporations from both strategies.

Partnerships with OGCI member companies

Identifying market gaps and collaborating to address them underpin our unique model, and we have been pleased to see collaboration and investment across sectors. Supplementary to their investment in CI funds, OGCI members have co-created or have co-invested in almost one-third of our CF1 portfolio companies.

The connection between CI and OGCI continues to drive exciting results for our portfolio companies and OGCI members. As climate impact successes emerge, the investment and deployment pipeline of opportunities expands with more mature companies seeking out partners to invest in and deploy their technologies. We look forward to showcasing such opportunities to a broader group of industrial companies. We have shared some examples of deployments between CI portfolio companies and OGCI members.

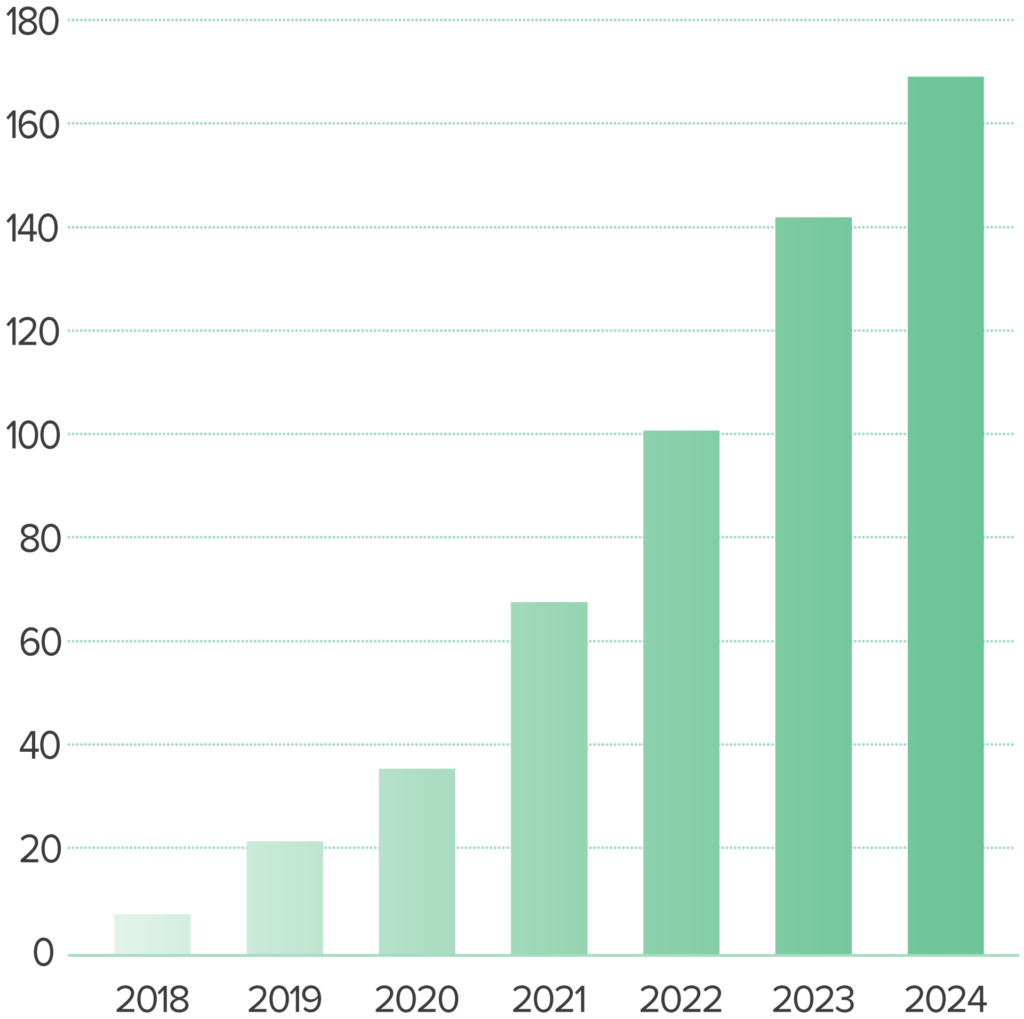

Cumulative Deployments with OGCI Member Companies

A prominent example of partnership with OGCI member companies is the OGCI Satellite Monitoring Campaign. Earlier in 2024, OGCI published the latest results of this campaign with CI methane portfolio company, GHGSat. The campaign conducted more than 530 high-resolution observations, targeting oil and gas sites in Algeria, Kazakhstan, and Egypt and resulted in the successful mitigation of three persistent methane emissions sources, which with an average rate of 3,200 kg of CH4 /hr, could have amounted to approximately 1 Mt CO2e annually if left unabated. The cost of detecting these emissions was found to be below $2 per tonne of CO2e.

Some deployment case studies

In addition to securing several strategic acquisitions designed to further advance market adoption in the U.S., Aeroseal announced a Memorandum of Understanding (MoU) with Aramco. The MoU with Aramco, which is a co-investor in Aeroseal alongside its CF1 investment, is part of an initiative with American companies to achieve net zero greenhouse gas (GHG) emissions by 2060. The MoU was signed in the presence of Minister of Energy for the Kingdom of Saudi Arabia, HRH Prince Abdulaziz bin Salman al Saud, and US Secretary of Energy, Jennifer Granholm.

Following a successful trial of Aeroseal’s duct and air sealing technologies, Aramco and Aeroseal agreed to explore opportunities to accelerate the deployment of Aeroseal’s technology. As part of this program, they will also explore commercializing the technology in new applications, such as gas pipelines.

Specializing in advanced methane detection, localization and quantification, using a direct open cavity measurement through a global network of drone service providers, SeekOps’ partnership with bp began in 2018 to manage fugitive emissions in the U.S.

Recognizing SeekOps’ consistent, accurate measurements, bp expanded the partnership globally. SeekOps now provides actionable, year-round data across bp’s onshore and offshore facilities, aiding OGMP 2.0 compliance and emissions reduction.

After five years of successful audits, bp broadened the collaboration to include regular, multi-site emissions surveys across its global upstream assets, reflecting bp’s confidence in SeekOps’ technology for transparent OGMP 2.0 reporting and rapid emissions abatement.

The SensorUp investment originated from a strategic collaboration between CI, BCG and Occidental. Occidental was an early adopter of several methane detection technologies but identified significant value in managing all methane data together in a single application. Occidental, an early adopter of methane detection technologies, saw the value in managing methane data in one application and became a design partner. SensorUp’s platform helps operators like Occidental understand their methane emissions landscape, centralizing data for regulatory compliance and insights into the root causes of emissions.

Occidental has deployed SensorUp across 5,500 sites, 21,000 wells, and 22,000 miles of pipeline and is expanding use across its enterprise. SensorUp recently launched “Powered by SensorUp” and is working with Open Geospatial Consortium on the EmissionML standard, further promoting interoperability and adoption between industry-wide partners, such as CI portfolio company Insight M.

Read about our portfolio of new and existing investments and their impact progress in CI’s Impact Report 2023 and on the CI website.

Looking forward

Across the CI portfolio we are focused on one overriding concern: is there a way for us to scale faster?

With their technology proven in home markets, CI portfolio companies are forging partnerships in new markets with both OGCI and non-OGCI companies that can help them propel their growth. These companies are demonstrating that CO2 emissions can be addressed quickly through innovation across sectors and geographic markets.

There are many cost-effective GHG abatement solutions which we can scale today and CI’s focus in 2024 is to build on the momentum that has gathered pace since COP28. We are proactively engaging with our global partners to bring the capital and commercial opportunities to enable those solutions to reach further and faster.

Join us in our mission.

Energy Systems

Buildings

Industry